Rumored Buzz on Feie Calculator

Table of ContentsThe Facts About Feie Calculator UncoveredUnknown Facts About Feie CalculatorMore About Feie CalculatorNot known Factual Statements About Feie Calculator Feie Calculator Fundamentals ExplainedHow Feie Calculator can Save You Time, Stress, and Money.Some Ideas on Feie Calculator You Need To Know

If he 'd often traveled, he would certainly instead finish Part III, providing the 12-month period he fulfilled the Physical Presence Examination and his traveling history - Physical Presence Test for FEIE. Step 3: Reporting Foreign Income (Part IV): Mark earned 4,500 per month (54,000 each year). He enters this under "Foreign Earned Income." If his employer-provided real estate, its value is likewise consisted of.Mark computes the currency exchange rate (e.g., 1 EUR = 1.10 USD) and converts his wage (54,000 1.10 = $59,400). Because he stayed in Germany all year, the percentage of time he lived abroad during the tax is 100% and he goes into $59,400 as his FEIE. Mark reports total salaries on his Form 1040 and gets in the FEIE as an adverse amount on Schedule 1, Line 8d, decreasing his taxable earnings.

Selecting the FEIE when it's not the most effective option: The FEIE may not be perfect if you have a high unearned income, make greater than the exclusion limitation, or stay in a high-tax nation where the Foreign Tax Obligation Credit Rating (FTC) may be extra helpful. The Foreign Tax Credit History (FTC) is a tax reduction approach frequently used in conjunction with the FEIE.

Not known Factual Statements About Feie Calculator

deportees to offset their united state tax obligation financial obligation with foreign income taxes paid on a dollar-for-dollar reduction basis. This indicates that in high-tax countries, the FTC can typically get rid of U.S. tax obligation financial debt entirely. Nonetheless, the FTC has restrictions on eligible tax obligations and the maximum case quantity: Eligible taxes: Only earnings tax obligations (or taxes instead of earnings tax obligations) paid to international governments are qualified.

tax obligation liability on your foreign revenue. If the foreign taxes you paid surpass this limitation, the excess international tax can generally be lugged ahead for approximately 10 years or brought back one year (by means of a changed return). Keeping exact records of international revenue and taxes paid is consequently vital to calculating the right FTC and preserving tax conformity.

migrants to reduce their tax obligation liabilities. If an U.S. taxpayer has $250,000 in foreign-earned earnings, they can leave out up to $130,000 utilizing the FEIE (2025 ). The remaining $120,000 may then undergo tax, however the united state taxpayer can potentially apply the Foreign Tax obligation Credit history to counter the tax obligations paid to the foreign country.

Everything about Feie Calculator

He offered his U.S. home to develop his intent to live abroad completely and used for a Mexican residency visa with his wife to help meet the Bona Fide Residency Examination. Additionally, Neil safeguarded a long-lasting residential property lease in Mexico, with strategies to eventually buy a home. "I presently have a six-month lease on a house in Mexico that I can extend one more 6 months, with the objective to acquire a home down there." Neil directs out that acquiring residential or commercial property abroad can be testing without initial experiencing the place.

"We'll absolutely be beyond that. Even if we return to the US for physician's consultations or organization telephone calls, I doubt we'll spend greater than one month in the US in any kind of offered 12-month duration." Neil stresses the value of stringent tracking of united state visits. "It's something that people require to be actually thorough about," he states, and encourages expats to be mindful of common blunders, such as overstaying in the U.S.

Neil takes care to stress and anxiety to united state tax authorities that "I'm not conducting any type of service in Illinois. It's just a mailing address." Lewis Chessis is a tax expert on the Harness platform with extensive experience assisting U.S. people browse the often-confusing realm of global tax compliance. One of one of the most usual mistaken beliefs amongst U.S.

What Does Feie Calculator Do?

income tax return. "The Foreign Tax obligation Debt enables individuals operating in high-tax nations like the UK to offset their U.S. tax obligation obligation by the quantity they've currently paid in tax obligations abroad," claims Lewis. This ensures that expats are not strained two times on the exact same earnings. Nonetheless, those in reduced- or no-tax countries, such as the UAE or Singapore, face extra difficulties.

The prospect of reduced living costs can be alluring, yet it frequently features trade-offs that aren't quickly obvious - https://www.mixcloud.com/feiecalcu/. Housing, for example, can be more budget-friendly in some countries, however this can indicate jeopardizing on facilities, security, or access to reputable energies and solutions. Inexpensive residential or commercial properties could be found in areas with inconsistent web, minimal mass transit, or undependable medical care facilitiesfactors that can significantly affect your day-to-day life

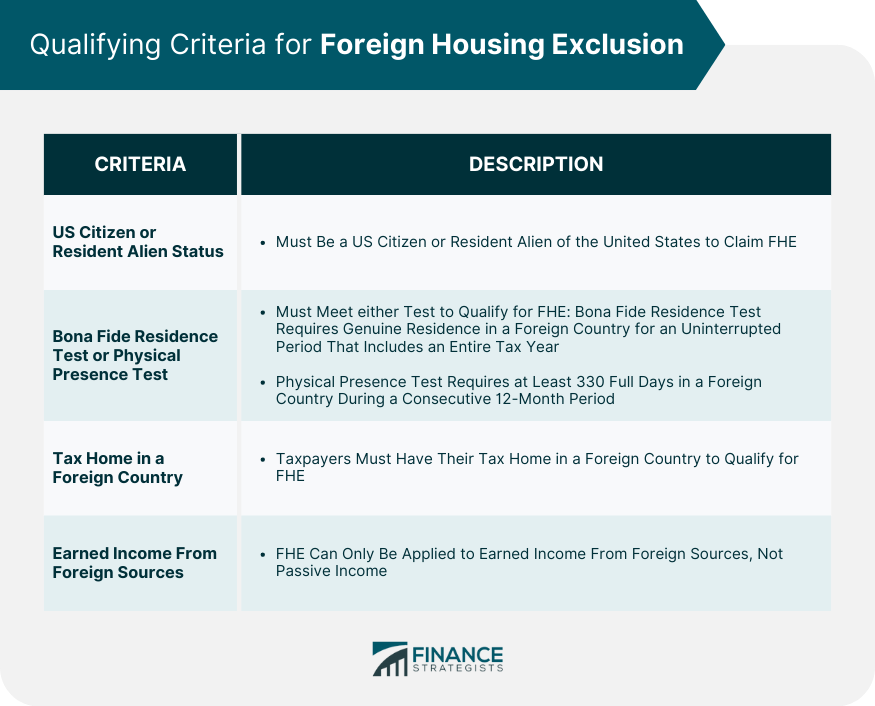

Below are a few of one of the most frequently asked inquiries about the FEIE and other exclusions The Foreign Earned Income Exclusion (FEIE) allows united state taxpayers to leave out as much as $130,000 of foreign-earned income from federal income tax obligation, lowering their U.S. tax obligation responsibility. To qualify for FEIE, you must fulfill either the Physical Presence Test (330 days abroad) or the Bona Fide Home Examination (show your key residence in an international country for a whole tax obligation year).

The Physical Visibility Test requires you to be outside the U.S. for 330 days within a 12-month duration. The Physical Presence Test also calls for U.S. taxpayers to have both a foreign earnings and an international tax obligation home. A tax home is specified as your prime place for business or work, regardless of your family members's residence. https://feiecalcu.carrd.co/.

Feie Calculator for Dummies

A revenue tax treaty between the U.S. and another nation can assist prevent double tax. While the Foreign Earned Earnings Exemption minimizes gross income, a treaty may give extra benefits for qualified taxpayers abroad. FBAR (Foreign Bank Account Record) is a called for declaring for U.S. residents with over $10,000 in foreign financial accounts.

Neil Johnson, CPA, is a tax advisor on the Harness system and the founder of The Tax Man. He has more than thirty years of experience and currently focuses on CFO solutions, equity compensation, copyright taxation, marijuana taxes and separation related tax/financial planning issues. He is a deportee based in Mexico.

The international earned earnings exemptions, sometimes referred to as the Sec. 911 exemptions, exclude tax obligation on earnings earned from working abroad.

Feie Calculator Fundamentals Explained

The tax advantage excludes the revenue from tax at lower tax rates. Previously, the exclusions "came off the top" decreasing income subject to tax obligation at the top tax rates.

These exclusions do not exempt the earnings from United States taxes yet just supply a tax obligation decrease. Note that a bachelor functioning abroad for every one of 2025 that gained about $145,000 without any other income will have taxed earnings reduced to absolutely no - properly the same solution as being "free of tax." The exclusions are computed every day.

If you went to service meetings or seminars in the US while living abroad, revenue for those days can not be omitted. For United States tax it does not visite site matter where you keep your funds - you are taxed on your worldwide earnings as an US person.